The Tesla Doom Loop

Putting my views on the record

My inaugural post in this newsletter was Tesla Isn't Going to Succeed in Robotaxis. Since then, I've circled back to Tesla Motors several times: analyzing the substance-free Cybercab launch, drawing the implications for Tesla from the Cruise shutdown, tracking the company's competition with Waymo, and behind it all, ever-increasing competition from China.

Courtesy of all that writing, I've built up a mental model of what I think is going to happen with Tesla, piece by piece, but I have never articulated it directly. For future reference (yours and mine), let's do that now. The model is as follows:

Tesla's valuation is built on a story, not its fundamentals

That story has two pillars, dominance in electric vehicles and Elon Musk's aura as an unstoppable innovator…

…but both are eroding

As they weaken, the company's dependence on its inflated stock price makes it acutely vulnerable to a self-reinforcing decline

The long-horizon projects meant to replace the old narrative, like robotaxis and humanoid robots, won't arrive in time to stop it

Let’s unpack those points in turn.

1: Tesla as a Narrative Stock

For 2024 Tesla’s price-to-earnings ratio was 176, the highest of any automaker in the world.1 For comparison, for the same year Toyota, Ford, and Stellantis (née Chrysler) all rounded to 7. So Tesla’s P/E ratio is extraordinarily high compared to its peer carmakers. It’s also extraordinarily high relative to tech stocks: in 2024 Microsoft and Apple’s P/E ratio was 38 and Amazon’s was 39.

Put another way, at the beginning of the year markets seemed to think that Tesla’s growth trajectory would be twenty-five times that of Toyota, and more than four times that of Microsoft or Amazon.

At the same time, Tesla's annual diluted earnings per share (EPS) fell 53% from $4.30 in 2023 to $2.04 in 2024, and is forecast to hit $1.39 for 2025.2

This is remarkable. How can we reconcile an astronomically high P/E ratio with a low and falling EPS? What would have to be true for this to be appropriate?

I can see only one interpretation: one would need to believe that the firm’s poor returns of the past few years are froth on the wave, and that Tesla will soon begin to make spectacular amounts of money. Investors aren’t buying on the fundamentals, they’re buying on a narrative where Tesla dominates the electric vehicle market for years to come, en route to dominating other sectors beyond it.

2: The Pillars of the Narrative

That narrative seems to rest on two beliefs:

Firstly, that Tesla's position in the electric vehicle market is unassailable. As the disruptive innovator that single-handedly created the modern EV market, Tesla benefits from:

Vertical integration from battery cells to semiconductor design, giving it control over supply chains

Higher margins than traditional automakers, even as it drives down its costs

Software-hardware integration that competitors struggle to replicate

The Supercharger network, so dominant that competitors abandoned their own standards to adopt Tesla's

For all these reasons, the narrative goes, Tesla is the default choice for EV consumers. As the EV market expands to become the entire vehicle market, Tesla will dominate it.

Secondly, that Elon Musk is unbeatable; as the proverb says, never bet against him. Conventional wisdom said that reusable rockets were impossible, and that there was no market for electric vehicles: Musk is the one who proved otherwise.

Nor is that all. Musk’s ownership of X provides him with a megaphone to shape public discourse and investor sentiment. He uses the platform to amplify his own messages, giving his views incredible reach. This power allows Musk to frame narratives around driving automation, artificial intelligence, and Tesla's progress in ways that traditional CEOs cannot match. When Musk discusses Tesla's robotaxi timeline or responds to critics, his messages reach hundreds of millions of users directly, bypassing traditional media filters and creating sustained attention for Tesla's initiatives. Naive investors fall under this spell. Cagey investors don’t, but they certainly place a value on Musk’s ability to cast it.

This narrative—Tesla's technological dominance, Musk's proven track record, and his unparalleled ability to shape opinion—drives the company's valuation. According to this story, Tesla owns the EV transition and is poised to dominate automation through robotaxis, humanoid robots, and artificial intelligence.

3: The Pillars Are Cracking

But that narrative isn’t plausible. It all rests on Tesla’s dominance of the electric vehicle market, which is eroding.

In China, the Chinese EV firm BYD outsells Tesla by almost four to one. One might say that the government manipulates the market to protect a domestic firm. But in Australia, a nation without a domestic automotive sector to protect, BYD now consistently outsells Tesla. Globally, BYD recorded $107 billion in revenue for 2024, surpassing Tesla's $98 billion.

Is it a fair fight? Certainly not: BYD, and other Chinese EV manufacturers, benefit from China’s control of battery production (China processes 90% of the world's graphite and ~65% of the world’s lithium and cobalt). We might add that China gives substantial state support to its EV manufacturers. But whether it’s a fair fight doesn’t matter: Tesla can’t stop China from doing this, and consumers seem indifferent.

It’s true that Canada and the USA protect their markets from Chinese competition with stiff tariffs; to a lesser extent, so does Europe. That gives Tesla an edge: it can aim to dominate the market for EVs in those places. Doing so would help it retain its valuation.

But lately the firm’s founder has done its best to ensure that it won’t.

This is not the place to rehearse all of Musk's personal excesses. Suffice to say Musk has staked out increasingly-pointed positions on X, and has made strong political associations in the USA and elsewhere, and the effect of these has been swift and damaging. His overall favorability rating among Americans plummeted from +24 in 2017 to -19 by 2025, with 57% viewing him unfavorably.

The decline has been catastrophic among Democrats, where his favorability crashed from +35 to -91. That’s particularly tough for Tesla, since EVs remain politically coded ‘left’ in the USA; Musk’s intemperance has made previously loyal customers flee. Tesla's customer loyalty peaked at 73% in June 2024 but plummeted to 49.9% by March 2025, meaning about a third of Tesla owners who would have bought another Tesla have decided to purchase other brands instead. Among those who keep their Tesla vehicles, there is now a market in anti-Elon bumper stickers.

Licensed under Creative Commons 4.0

The damage internationally is worse. In Europe, BYD vehicle registrations rose 359% year-over-year in April 2025, while Tesla's fell 49%. Tesla registered only 1,277 new cars in Germany in January 2025, a 59% drop compared to the same month in 2024, reducing its market share from 14% to 4%, even as Germany's EV market grew 50% year-over-year.

4. The Doom Loop

So Tesla’s got stiff competition and its CEO has tarnished the brand. Does that mean Tesla is about to fall apart? That may be true, but it’s not obviously true. For instance, the firm isn’t overleveraged. It ended 2024 with roughly $36.6 billion in cash and short-term investments versus $7.9 billion total debt. On paper, the balance sheet looks strong.

Tesla’s problem is not overextension, but fragility.

As its incredible P/E ratio suggests, Tesla equity is extremely valuable, which gives the company remarkable freedom of action. It compensates employees by making stock grants, and it funds expansion through issuing new shares. It doesn’t need to take on debt to do this, which is why the balance sheet looks so good; to flourish, it only needs strong equity value.

But just as rising stock price makes everything easier, falling stock price makes everything harder. A decline would make hiring and retention more expensive while making new equity raises increasingly dilutive.

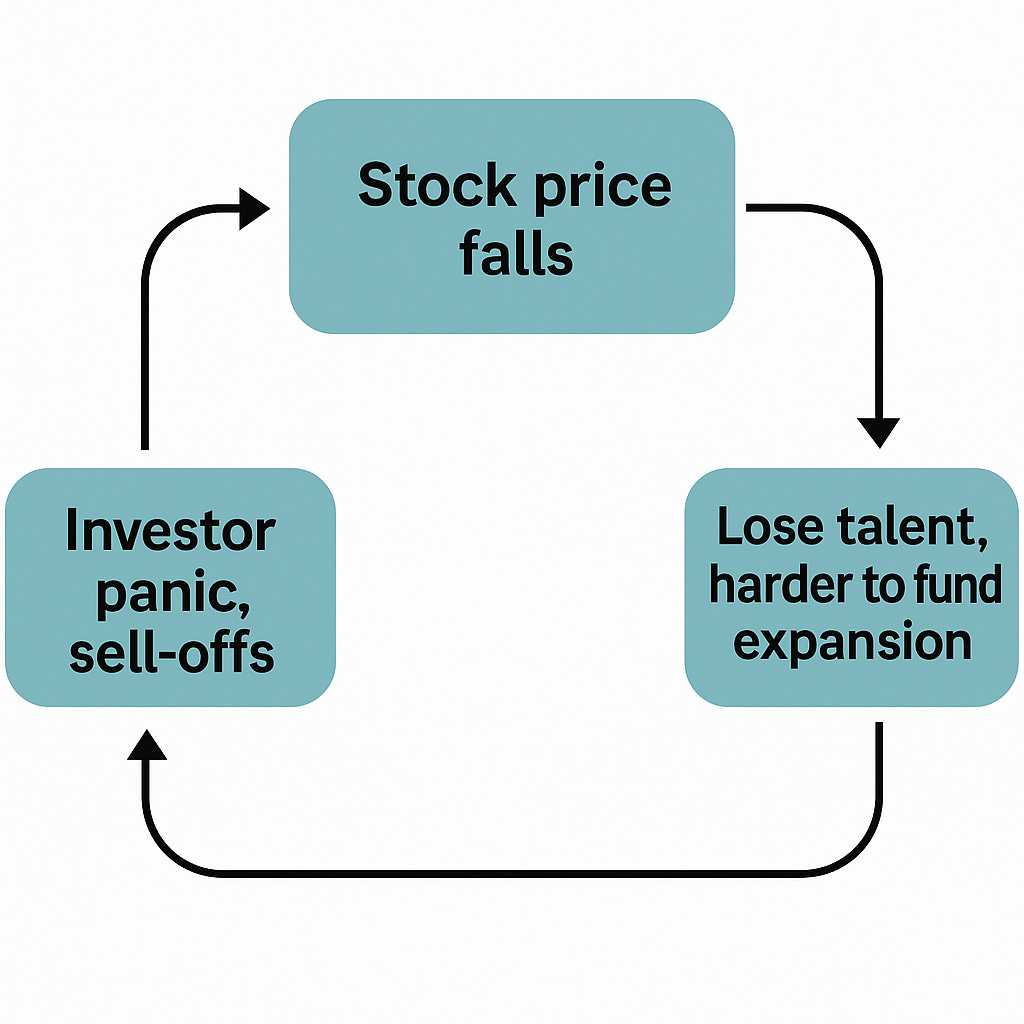

Enter the doom loop:

In any high-growth company, a downdraft hurts. In a company priced far above its peers, the downdraft lasts longer because it has further to fall. During the descent, three reinforcing problems appear:

Compensation compression: When equity is half the package, a 40% share decline is a 20% pay cut. Senior engineers and managers have alternatives and leave; departures beget departures

Capital becomes expensive: New share sales are more dilutive just as the company needs capital most. Debt remains available but worsens the balance sheet, accelerating the slide

Strategic patience evaporates: Management attention focuses on ‘fixing the quarter’, meaning that long-horizon bets become targets, and projects requiring multi-year burn suddenly look irresponsible, even though these are what might actually improve matters

Such a loop could befall any company, of course, and need not become a doom loop. At some point, the stock would go low enough that investors would think it had fallen below fundamentals and so they would start to buy, and the wheel would turn in the other direction: rising stock price, easier to expand, investors buy more, and so on.

The problem here is that the firm is trading so far above its fundamentals, that the doom loop would run a long time. Tesla would need to fall roughly 90% from current levels to reach the P/E ratios of comparable automakers. During such a prolonged decline, the company would lose its primary funding mechanism, face constant talent hemorrhaging, and struggle to maintain investor confidence for long-term projects.

This is not hypothetical. Netflix in 2011, Meta in 2022, and Lucid Motors in 2023 all found that when a high-multiple stock loses altitude, the resulting hiring challenges, capital constraints, and narrative collapse can reinforce the slide.

What could trigger this loop? As noted earlier, Chinese competition and brand damage are good candidates, but there’s another: Musk's personal leverage. According to the firm’s 2024 10-K filing, Musk has pledged 238.4 million shares (7.4% of total stock) as collateral for personal loans. The filing warns that forced sales "could cause our stock price to decline". The typical loan-to-value ratio is 35%, meaning a 40% decline from current levels could trigger margin calls. If Tesla's stock declined to $190—where it traded as recently as April 2024—it could force Musk to begin liquidating shares, potentially kickstarting the doom loop.

I argued earlier that the misalignment between Tesla’s P/E ratio and EPS only made sense if investors believed that Tesla would soon begin to make gigantic profits. “Only” was too strong; another explanation might be that some (many? most?) investors think Tesla won’t make gigantic profits… but that other investors do think it will, and smart money can take advantage of that belief. If so, this explanation offers another trigger for a doom loop. If the smart money is speculating on Tesla rather than investing, at some point it will want to cash out its profits and head for the exit. If enough smart money does so, the sell-off could set the doom loop in motion.

5. Robotaxis Won’t Save the Day

Tesla's next act, Musk has told us, is robotaxis and Optimus humanoid robots. Tesla is becoming an applied-AI company.

These are difficult aspirations for a firm that, as we have seen, is losing its grip on its fundamentals. They’re difficult because both new product lines are long-gestation, capital-intensive, and regulation-heavy bets.

For robotaxis, the path to scaled service will be long. Waymo took roughly 15 years from inception to meaningful multi-city paid service. Zoox started in 2014 and only began limited paid rides in 2024. Even if Tesla can halve this timeline by leveraging its existing technology, that would mean meaningful revenue is at least five years away. As of June 1, Tesla has obtained California permits for safety-driver testing, but not for driverless testing, let alone driverless operation. Some credulous reports have suggested that Tesla has launched robotaxis in San Francisco, but that’s fiction: it’s a chauffeur-driven service using Tesla vehicles with occasional FSD engagement. What Tesla has done is create a conventional ride-hailing service but that seems to support claims that it is expanding its robotaxi footprint. It is marketing vapourware.

The edge for Tesla’s robotaxis was supposed to be its superior driving-automation software, but Tesla has just shut down its Dojo supercomputer project. Musk has positioned Dojo as "the cornerstone of Tesla's AI ambitions" since 2019, claiming it would process "truly vast amounts of video data" essential for achieving full self-driving capability. To be clear, the company isn’t abandoning its AI ambitions, but it does intend to proceed entirely with external silicon (Nvidia and Samsung), undercutting any claim that its bespoke training stack is a unique competitive advantage. Shutting Dojo down is hardly the mark of a company about to revolutionize automated driving.

The Optimus robot situation is equally grim. Despite promises of 5,000 units in 2025, Tesla has built only "in the hundreds" nearly eight months into the year. Production bottlenecks, leadership turnover, and fundamental technical challenges—particularly engineering human-like hand dexterity—have left Tesla stockpiling mostly complete robot bodies lacking functional hands and forearms. This is unsurprising, because notwithstanding Musk’s claims otherwise, there is no reason to think that Tesla has any comparative advantage in producing humanoid robots at all.

Unlike humanoid robots, robotaxis exist: Waymos ply the streets of San Francisco, and Tesla is running its own service in Austin. That sector isn’t speculative, it’s real, and its potential for growth and profit is obvious. Doesn’t that mean that investors will give Tesla the support it needs to get a piece of it?

Unfortunately not. In robotaxis, Tesla is competing against wealthy monopolists: Waymo (Google and web search) and Zoox (Amazon and online retail). Not for nothing did I write that The Cruise Shutdown Is Bad News for Tesla: the other prominent player in this space in the USA was Cruise, backed by GM. Like Tesla, GM was a carmaker, with the advantages that it should have had in the space. But also like Tesla, GM did not have a monopoly, and as its losses mounted it gave up on robotaxis, after sinking $10 billion into the effort… because it couldn’t afford to keep losing money.

No matter how much profit there would be at the end of the road, GM couldn’t afford to travel all the way there. Waymo and Zoox can, perhaps, because their parent companies have moats around their core business. Tesla does not; all it has is its equity price, which is vulnerable.

Counter-Arguments I Don't Accept

"But Tesla has $36 billion in cash!" Cash provides operational runway but can't prop up the equity price, nor overcome the firm’s structural disadvantages against Chinese competitors.

"But Tesla can slash prices!" Tesla has already cut prices multiple times yet continues losing share globally. Chinese manufacturers benefit from lower labour costs, state subsidies, and battery supply control. If Tesla matched their prices, it would increase sales but destroy its profitability.

"But Tesla's vertical integration gives it a moat!" This argument was compelling in 2020 but events have overtaken it. Tesla gave up its Supercharger network advantage by permitting any EV using the NACS standard to use them; even if it rescinded those permissions, competing charging infrastructure continues to expand. It’s true that Tesla is vertically integrated in a way that its non-Chinese competitors are not… but its Chinese competitors like BYD are so integrated, and in regards to battery tech, more so.

"But what about Tesla's energy storage business?" Tesla's Megapack business does indeed show promise, but this market not only suffers from the same intense Chinese competition that automotive does, but it also operates at lower margins. Tesla's current valuation can’t rest on this.

"But Musk is friends with the President! He’ll get regulatory advantages out of that!" In the early days of the Trump Administration, Musk did indeed seem to benefit from the easing of federal regulations around driving automation, and the fact that Musk had befriended the President seemed the likely cause. But the extent to which the President remains friends with Musk is not obvious, and it’s just as easy to imagine that the Administration will ultimately use its regulatory powers to punish Musk’s businesses, both existing and future.

What Would Change My Mind

If the facts change, so does my position; I'm committed to updating my views based on evidence. In that spirit, here’s what would induce me to recant.

Automotive gross margins above 20% for six consecutive quarters while growing volume

Total company revenue growth of 20%+ annually for two consecutive years

$1 billion in annual revenue from the robotaxi or Optimus business lines by 2030 (for context, last year Tesla made $100 billion in revenue)

Maintaining >15% global EV market share for four consecutive quarters

Brand favorability recovering to 2022 levels in key markets

If Tesla achieves any three of these benchmarks, it would demonstrate genuine technological and market leadership rather than narrative-driven speculation, fundamentally altering the investment case.

Until then, I stand by my view that Tesla's sky-high valuation balances on two weakening props: its core business selling EVs, and Musk's mystique. Chinese competition is eroding the first; Musk's antics have shattered the second.

That sets the firm up for a doom loop. That isn't guaranteed, but the conditions for it are all in place. If the stock starts sliding, the company's equity dependence and Musk's collateral situation can turn that slide into a spiral, and the robotaxi and robot projects that might save the day face technical, regulatory, and timeline challenges that make it unlikely they will arrive in time, if at all.

None of this is intended to be investment advice; to misquote Keynes, the market can assign irrational values to Tesla’s stock price longer than you can stay solvent. Even so, Tesla’s structural vulnerabilities are clear, present, and growing. Unless something fundamental changes, the ending is predictable, even if the timing isn't.

Respect to Emma McAleavy, Jeff Fong, and Julius for feedback on earlier drafts of this essay.

Update 22 August 2025: clarified that the Dojo shutdown marks Tesla’s retreat from producing its own chips, not AI per se.

The price-per-earnings ratio, or P/E for short, is a way of asking "How many dollars of share price are you paying for each dollar of yearly earnings?" A P/E of 20 means that for each $1 of the company’s yearly earnings, investors are willing to pay $20. A low P/E suggests that the market thinks the company’s earnings will not grow significantly in the future, while a high P/E is a bet on rapid future growth.

Earnings per share, or EPS, is how much money a company makes, divided by the number of outstanding shares of stock: so a large multinational that makes net income of $5 billion with 1 billion shares outstanding would have an EPS of $5; so too would an up-and-comer with net income of $50 million and only 10 million shares outstanding. Given that two such different firms can have the same EPS, the way to use it is to note whether the EPS is rising or falling: rising EPS might suggest a firm is becoming more profitable or the market thinks that it will be soon, while falling EPS might suggest the opposite.

Hi Andrew, I am impressed enough with some of your writing to reply pointing out several important factual errors that I believe are leading your analysis astray. First relying on poor-quality sourcing gave you completely false information about what Dojo is/was, its relationship to AI training, and Tesla’s in-house AI efforts.

Dojo is a Tesla designed computer chip specifically for AI model training. It is a competitor to Nvidia AI/GPU chip. Other companies doing this are: Meta, Google, Amazon, Microsoft, and OpenAI. (1) All of these companies design the chips and use foundry companies like TSMC or Samsung to build the actual chip hardware.

Tesla’s on-car computers use its in-house FSD Computer. These are AI inference chips. Originally Tesla used a Nvidia chip in their “Hardware 2” when Autopilot 2 first debuted. In 2016 they started work on “Hardware 3” or “FSD Computer 1” and began installing them in all their cars in 2019.(2) You can think of this as Apple switching from Dragon and Intel chips for iPhones and Macs to their “A” series of in-house chip designs. AI3 was replaced with “Hardware4” with “AI4” chips in 2021.(3) Both generations fabbed by Samsung. Next year Tesla is switching to “AI5” built by TSMC. Finally Tesla just inked a #13 billion + contract with Samsung to build their “AI6” chips in Samsung’s new Texas Fab (at 2 nm process) by 2027.(4)

The news a few weeks ago was that Tesla is cancelling the development effort for DOJO version 2 and 3 and using the AI6 chips for their next, next supercomputers in 2027. Remember both are chip designs not computers.

Tesla’s latest supercomputers are Colossus 1 (operating since Dec. 2024) and Colossus 2 (under construction). These are build with Nvidia AI/GPU training chips and Colossus 1 is what is currently used to train new versions of FSD. (5)

So your paragraph:

“The edge for Tesla’s robotaxis was supposed to be its superior driving-automation software, but Tesla has just shut down its Dojo supercomputer project. Musk has positioned Dojo as "the cornerstone of Tesla's AI ambitions" since 2019, claiming it would process "truly vast amounts of video data" essential for achieving full self-driving capability. Its abandonment signals Tesla's retreat from in-house AI development in favour of external partners, which is hardly the mark of a company about to revolutionize automated driving.”

Is wrong. Colossus is not shutting down. FSD AI is not being outsourced. Tesla was iterating on two chips families the AI series and Dojo and they decided to ax Dojo and focus

By the way, look at the list of who does in-house AI chips designs. See any Auto OEMs there? Only the biggest tech/AI firms. Maybe GM and Ford are nothing like Tesla in important ways that you have not researched.

Maybe Elon Musk, who co-founded Open AI and then founded X.ai and took it from zero to the highest scoring AI chatbot in last than three years, might know something more about AI than Mary Barra. Things to think about.

(1) https://medium.com/%40frulouis/6-tech-giants-dominating-the-2025-semiconductor-ai-chip-race-b9b3dac7e498

(2) https://en.wikichip.org/wiki/tesla_%28car_company%29/fsd_chip

(3) https://www.autopilotreview.com/tesla-hardware-4-rolling-out-to-new-vehicles/

(4) https://techcrunch.com/2025/07/28/tesla-signs-16-5b-deal-with-samsung-to-make-ai-chips/

(5) https://www.teslarati.com/xai-tesla-megapack-colossus-2/

While the financial fundamentals don't make sense, which has been the case to different degrees for a long time, there are two things you didn't mention that I think are important:

1) Elon's personality attracts top technical talent, and while his reputation elsewhere has diminished, I don't think that has impacts top talent still wanting to work for him. Moths to a flame.

2) The performance, technology, and user experience of Tesla's cars is top notch, including the Supercharging network. BYD and others may come close, or even match/exceed it at some point, but this still a major factor. And while FSD has some issues, having tested it every day for almost a year, I can say it's very good. The edge cases are being addressed quite rapidly, so we'll see if that continues.

I'm not saying the confluence of factors you've mentioned won't necessarily create a doom loop, but I believe these are non-trivial advantages in Tesla's favour.